Post Office PPF Scheme : For countless individuals in India, the Post Office Public Provident Fund (PPF) is more than an investment scheme—it’s a trusted partner in their journey toward financial security. With its unique blend of sovereign guarantee, tax efficiency, and long-term growth, the PPF offers a stable foundation in an often unpredictable economic landscape. It serves as a reliable tool for planning life’s major milestones, from securing a comfortable retirement to funding a child’s education.

Why the PPF Stands the Test of Time

Managed under the National Savings Institute, the PPF is designed with a 15-year tenure to encourage disciplined, long-term saving. This extended period aligns perfectly with long-range goals, allowing your investments to grow steadily. A particularly flexible feature is the option to extend the account in blocks of five years after maturity, making it a lifelong financial companion that can adapt to your evolving needs.

The Magic of Compounding Interest

The true power of the PPF lies in the effect of compounded interest. The interest, currently 7.1% per annum, is calculated annually and added to your principal. This means that each year, you earn interest not just on your deposits, but also on the accumulated interest from previous years. Over 15 years, this creates a powerful snowball effect, transforming regular savings into a substantial corpus without exposing your capital to market risk.

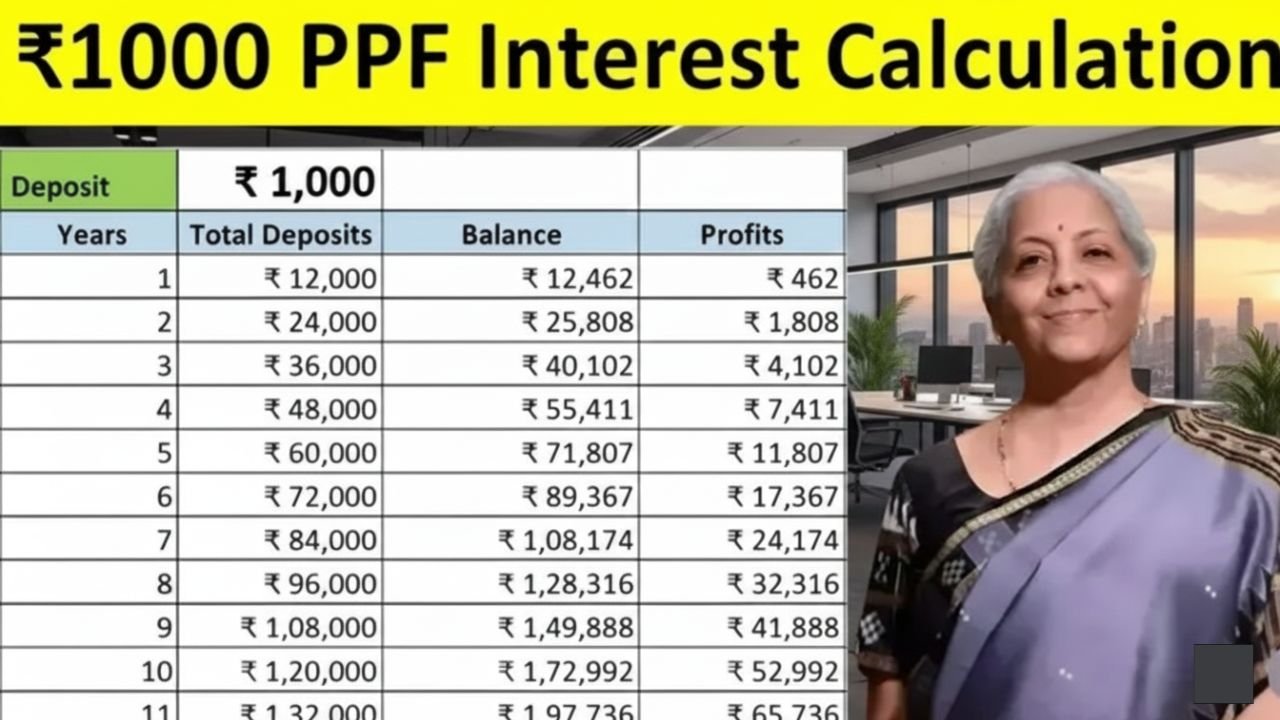

A Detailed Look at Potential Growth

The table below provides a clearer picture of how consistent annual investments can grow over the full tenure. These figures are projections based on the current interest rate and illustrate the potential of disciplined saving.

Post Office PPF Scheme Complete Information Table

| Feature | Detail |

|---|---|

| Scheme Tenure | 15 years (can be extended indefinitely in 5-year blocks) |

| Current Interest Rate (Q4 FY25) | 7.1% per annum, compounded yearly |

| Interest Payout | Credited annually on March 31st |

| Minimum Annual Deposit | ₹500 |

| Maximum Annual Deposit | ₹1.5 lakh in a financial year |

| Tax Status | EEE (Exempt-Exempt-Exempt) category |

| Who Can Open an Account | Indian residents (individuals or on behalf of a minor). HUFs and NRIs are not eligible. |

| Number of Accounts Allowed | One per individual (excluding accounts for minors) |

Projected Maturity Estimates (Based on 7.1% annual compounding)

| Annual Investment | Total Amount Invested (Over 15 Years) | Approximate Maturity Value | Interest Earned |

|---|---|---|---|

| ₹25,000 | ₹3,75,000 | ₹6,78,000 | ₹3,03,000 |

| ₹50,000 | ₹7,50,000 | ₹13,56,000 | ₹6,06,000 |

| ₹1,00,000 | ₹15,00,000 | ₹27,12,000 | ₹12,12,000 |

| ₹1,50,000 | ₹22,50,000 | ₹40,68,000 | ₹18,18,000 |

Understanding the Triple-Tax Benefit (EEE)

The PPF’s tax advantage is a cornerstone of its appeal:

- Exempt on Investment: Contributions up to ₹1.5 lakh per year qualify for deduction under Section 80C of the Income Tax Act.

- Exempt on Interest: The annual interest earned is completely free from income tax.

- Exempt on Maturity: The entire final amount, including all accumulated interest, is tax-free upon withdrawal.

This structure ensures that the returns you see are entirely yours to keep, enhancing the effective post-tax yield compared to many other investment avenues.

Flexibility for Life’s Uncertainties

While designed for the long term, the PPF incorporates sensible liquidity features:

- Partial Withdrawals: From the 7th financial year onward, you can make one withdrawal per year, subject to terms and conditions based on your account balance.

- Loan Facility: Between the 3rd and 6th financial years, you can take a loan against your PPF balance, providing access to funds without breaking the investment cycle.

- Account Extension: At maturity, you can choose to extend your account while continuing contributions, or let the existing balance earn tax-free interest without further deposits.

Who Should Consider a PPF Account?

The PPF is a versatile instrument suited for a broad spectrum of savers:

- Salaried professionals seeking a stable, long-term supplement to their retirement corpus.

- Self-employed individuals and business owners looking for a disciplined, government-backed savings plan.

- Parents and guardians building a dedicated fund for a child’s future education or marriage.

- Risk-averse investors who prioritize capital protection and guaranteed returns.

- Individuals in higher tax brackets seeking an efficient, long-term wealth accumulation tool.

Frequently Asked Questions (FAQs)

1. Where can I open a PPF account?

You can open an account at any head post office or at authorized branches of most major public and private sector banks across India.

2. What happens if I don’t deposit the minimum ₹500 in a year?

The account becomes inactive. To reactivate it, you must pay a penalty of ₹50 for each defaulted year along with the minimum deposit of ₹500 for each of those years.

3. Is the 7.1% interest rate locked in for 15 years?

No, the government reviews and announces the PPF interest rate every quarter. The rate applicable to your account is the rate announced for each quarter in which the interest is credited.

4. Can I transfer my PPF account?

Yes, PPF accounts are fully transferable between post offices and authorized banks nationwide at no cost, which is helpful if you relocate.

5. How are nominations handled?

You can appoint one or more nominees when opening the account or later by submitting the prescribed form. This ensures a smooth transfer of funds to your beneficiaries.

6. Can an NRI continue an existing PPF account?

An existing PPF account holder who becomes an NRI can continue the account until its original 15-year maturity without further contributions. However, NRIs cannot open new PPF accounts.

Final Reflections A Pillar of Financial Well-being

The Post Office PPF Scheme embodies the virtues of patience and consistency. In a world chasing high-risk, high-reward opportunities, the PPF offers the profound value of certainty. It may not be the fastest route to wealth, but it is one of the steadiest. By starting early and investing regularly, you harness the quiet, relentless power of compounding. The PPF can serve as the secure, dependable core of your financial portfolio, allowing you to build a legacy of security for yourself and your loved ones with peace of mind.